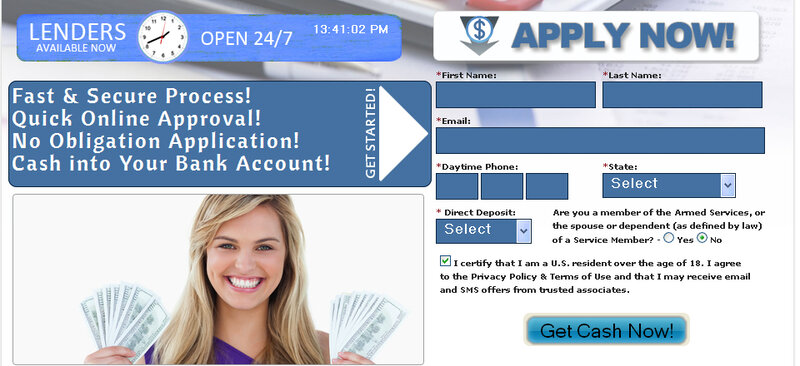

Easy Steps to Obtain a Quick Online Payday Loan

Easy Steps to Obtain a Quick Online Payday Loan

Blog Article

Discover the Secret Credentials Needed for Protecting an Online Car Loan Successfully

In the realm of online lending, recognizing the important credentials for safeguarding a lending efficiently can make a considerable difference in one's economic trajectory. Specific vital variables play a pivotal duty in figuring out one's eligibility for an on the internet funding when it comes to browsing the online landscape of borrowing. From the foundational aspects like credit history and earnings confirmation to the intricate information of debt-to-income ratio and security needs, each criterion brings its weight in the approval process. These certifications serve as the gatekeepers to accessing financial support in the electronic age, forming the restrictions and opportunities individuals might experience on their path to protecting an on-line financing.

Credit Report

A critical factor in protecting an on the internet financing is preserving a healthy and balanced credit rating. A greater credit scores rating suggests to lenders that you are a responsible borrower who is most likely to pay off the financing on time, making you a much more appealing candidate for an on the internet loan.

To boost your opportunities of safeguarding an on-line loan, it is vital to keep track of and manage your credit report regularly. This includes making prompt repayments on existing financial obligations, maintaining charge card balances low, and preventing opening multiple new accounts within a short period. By showing excellent monetary practices and keeping a high credit history, you can boost your eligibility for on the internet finances with favorable terms and passion prices.

Income Verification

Given the critical function of debt score in the lending authorization procedure, the next important facet that loan providers usually concentrate on is verifying the applicant's revenue. Revenue verification serves as a basic standard for lending institutions to examine an individual's capability to pay off the loan.

A lower debt-to-income proportion signifies that the consumer has sufficient revenue to cover loan repayments comfortably. Ensuring detailed and exact earnings confirmation paperwork can considerably boost the opportunities of protecting an on-line funding successfully.

Employment History

Just how does a candidate's employment history affect their qualification for an online financing? When using for an on the internet funding, lenders often think about an applicant's work background as an important consider the decision-making process. A secure work with a regular earnings stream not just shows the debtor's ability to pay off the finance but likewise shows a degree of financial duty and integrity.

Lenders commonly look for a consistent employment record to assess the applicant's repayment capability. A longer tenure with the exact same company or within the exact same sector can boost the customer's reliability, showing a minimized threat of default. Additionally, a history of regular pay elevates or promotions may better reinforce the consumer's instance for finance approval.

However, regular task adjustments or prolonged periods of joblessness could elevate concerns for lending institutions concerning the candidate's monetary security and payment ability. In such cases, giving a thorough description for any type of gaps in work history might aid reduce these issues and boost the chances of safeguarding the on the internet financing effectively.

Debt-to-Income Ratio

A reduced debt-to-income proportion indicates that a borrower has more non reusable revenue readily available to satisfy brand-new payment responsibilities, making them a much more attractive prospect for a funding - Payday Direct Loans Online. Typically, lenders like to see a debt-to-income ratio below 36%, consisting of the prospective funding payment

Collateral Requirements

After assessing an applicant's debt-to-income proportion to evaluate their monetary stability, lending institutions may call for collateral as a safety and security step when thinking about on the internet financing applications. Usual types of collateral approved for Click This Link on-line financings include genuine estate, cars, savings accounts, or beneficial assets like fashion jewelry. It is vital for borrowers to comprehend the effects of using security for protecting an online financing, as failing to settle the lending can result in the loss of the promised properties.

Verdict

Finally, individuals seeking to protect an online funding effectively must fulfill crucial certifications such as a great credit history, verified revenue, secure employment background, a favorable debt-to-income proportion, and possibly collateral requirements. These qualifications are necessary for lenders to examine the consumer's economic stability and capacity to settle the financing. Satisfying these requirements enhances the probability of authorization for an on-line funding.

A greater debt score shows to lending institutions that you are an accountable consumer who is likely to pay back the loan on time, making you a much more eye-catching prospect for an online finance.

Guaranteeing exact and thorough income verification documentation can considerably boost the possibilities of protecting an on the internet finance efficiently. (Easy to find a Fast Online Payday Loan)

After assessing an applicant's debt-to-income proportion to assess their economic stability, lending institutions might call for collateral as a protection action when considering online lending applications. It is important for debtors to recognize the ramifications of making read more use of collateral for safeguarding an on-line lending, as failure to pay off the loan can result in the loss of the vowed properties.In conclusion, individuals seeking to secure an online car loan efficiently must satisfy essential certifications such as a good credit history rating, verified revenue, secure work history, a favorable debt-to-income proportion, and possibly collateral requirements.

Report this page